Listen to this episode as a 12 minute podcast:

Remember in Land Before Time when LittleFoot and his mother go in search of the Great Valley? When he finally gets to the lush beautiful oasis he was promised, it’s dry and dead.

That’s what most personal finance advice is like.

I consume a lot of personal finance content. I read blogs about inflation and books about famous market crashes. I listen to podcasts discussing stock picks. I research investing trends.

Hell, I have a website devoted to money.

I also grew up in a home that started out using food stamps and hand-me-downs. It’s second nature for me to be good with money because I had to be.

I have very little raw talent and therefore very little ability to ever earn a big six figure salary. I don’t say this to be self-deprecating, but to explain why I have to be smart with my money. It’s been my only edge for decades. I might not make more than my peers, but I can probably save and invest better than them.

It’s like the world’s lamest super power.

Like any good hero that discovers a super power (even a lame one), I am also interested in helping other people be better with THEIR money. I’m interested in what works and what doesn’t. So I follow other people on social media who are doing the same thing to see what’s working. Surely these people are all as honest and helpful as Abe Lincoln picking you up from the airport.

Nope.

This is where the promised land turns out to be a wasteland and there is not always a happy ending for Littlefoot and his friends.

I’ve noticed most “influencers” use their platforms to humble brag or spew the same tired cliches about budgeting and hustling. I know I’m guilty of this to some degree, but I’m really trying to balance that line. What you see is what you get with me. Warts and all.

I understand how it happens though. They have limited characters on Twitter. Limited real estate on their Instagram post. Limited time in their TikTok video. And they’re trying to make a big splash in as little time as possible.

But here’s why you’ll never see me post my net worth, how much debt I did or didn’t pay off in a year, and what my overall market returns are:

That self promotion is simply unhelpful. But for some, that self promotion is downright damaging.

Exhibit A:

I saw this on Instagram the other day on a very popular personal finance account. Not to pick on anyone, but this shit has got to stop.

No budget in the world is getting the average person there.

It’s like Lebron James tweeting about how easy it is to get into the NBA – all you need to do is be 7 feet tall and great at basketball. Simple, right? It’s basically trolling. But it gets eaten up by the hustle and grind culture of social media.

If you’re trying to help well-educated middle-class millennials who’s well-educated middle-class parents raised them to be aware of money and get a good education, okay fine, you might help them budget for a brand new Toyota instead of a brand new Mercedes.

But here are the real groups that need help:

Why sharing these types of numbers is neutral at best.

You have no clue where anyone started. If they tell you, you have no way of verifying it. You don’t know their upbringing, their inheritances, or their goals. And they don’t know yours.

You don’t know their education, their income, or the city they live. And they don’t know yours.

You also don’t always know what they’re trying to sell you or what ad revenue they are receiving or what affiliate partnerships they have when you click on their links.

There is no budget in the world that is going to get you or anyone else a quarter of a million dollars in cash in 3 years unless you are already a high earner or very wealthy, so let’s knock off the charade. This is an echo chamber at its finest.

No two situations are the same so no two outcomes will be the same when you start tweaking the dials. This is why it’s unhelpful to share your numbers and comes off as a platform for you to humble brag more than help.

But let’s say you actually are trying to help people and you mean well.

Why sharing your extreme numbers could be doing more harm than good.

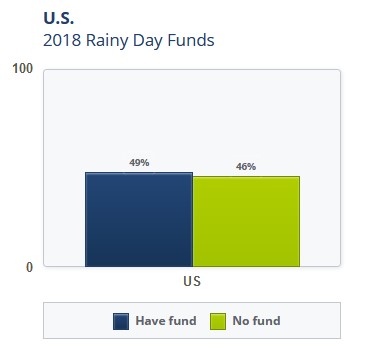

Someone may read about your amazing bank account, feel bad about themselves for having only a tiny fraction of your wealth, and throw their hands up saying the world is rigged so why even play the game.

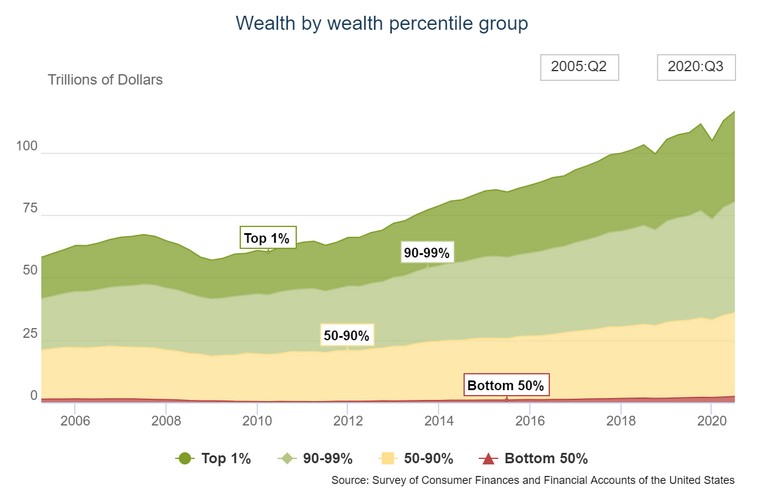

The 1% should not be where the 99% take their cues from.

No wonder we are seeing teenagers YOLOing their life savings into meme stocks on Robinhood. They are gambling. Because gambling is the only way you’re going to make $231,000 CASH in 3 years. But 99% of gamblers lose (and 86% of day traders). And the 1% of winners touting their windfall is promising hope where there is none to be found.

Just like the lessons most non-investors might take away from the Gamestop saga which I wrote about here.

Okay, Smart Guy, what is helpful then?

Timeless and evergreen tips like these:

- Save more than you spend (even if you live at home with your parents earning minimum wage).

- Make yourself indisposable at work (even if that means someone relies on you for their coffee every morning).

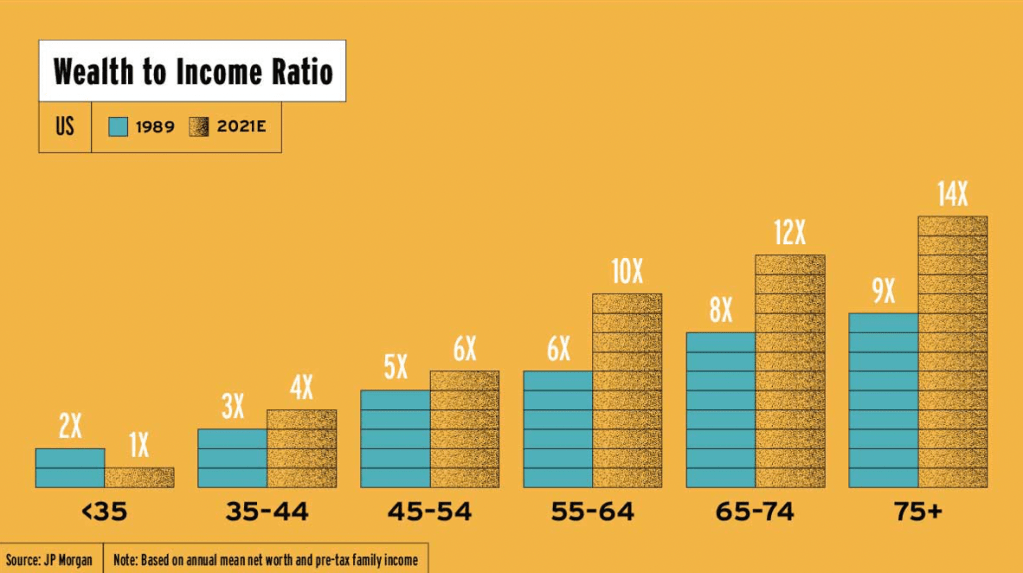

- Start investing earlier than you think you need to (the years are short but the nights last forever – this is why it feels like you have plenty of time but your 60s will actually be here before you know it).

- Automate your investments (turn on your 401(k) deposits, make regular IRA deposits, even if it’s just an automatic transfer from your checking account to your savings account each paycheck).

- Don’t worry about what other people are doing (most people are drowning in debt trying to impress you).

- Don’t give into FOMO by buying the latest meme stock or penny stock (even though it can be REALLY hard to watch complete idiots getting rich – it won’t last forever).

- Keep learning even after school (read, listen to podcasts, watch documentaries, take on new challenges just for fun).

- Track your money (use a simple excel chart or find an app; you can’t know if you’re saving more than you spend unless you track it. Treat it like a game where the goal is to do better each month and level up).

- Practice gratitude for the money and things you DO have (especially friends, pets, and loved ones).

- Go to community college if you are even the slightest bit unsure of what degree you want (and even if you are sure!).

I’ll stop yelling at the clouds now.

Sign up for the newsletter here:

For an ironic twist of events, check out my Instagram: @TheSensibleMerchant

More reading:

What Is a Buyer-Agent Agreement – And Why It’s the Smartest Move You Can Make When Buying a Home

Buying a home is too big of a decision to go it alone or leave it to chance. That’s where a Buyer-Agent Agreement comes in.

Keeping Up with Yourself

Keeping up with yourself can be a great fuel—and an even greater trap. The art is knowing when to press forward, and when to simply be where you are.

(5 min read)

Why You (and I) Need a Career Coach

I messed up at work but survived — thanks to my career coach. Spoiler alert: British football analogies included.

You must be logged in to post a comment.