I remember the first time I drove a car, the first time I used the internet to download music, and the first time I paid my own electric bill.

It’s obvious why the invention of each of these technologies marked a turning point in the lives of humans.

Sure, you can get around without a car and live a happy and productive life without the internet or electricity. But I’m referring to the broader impact of transportation, the internet, and electricity on the world and how much they’ve been integrated into everyday life. Even if you use none of them (which would be a lie because you’re reading this), you can’t argue that they haven’t changed the world.

There were stock market bubbles associated with all three of these technologies. The railroad mania bubble of the 1840s (transportation/freedom/industry), the bull market of the 1920s due to the invention of new devices and appliances that took advantage of newly available energy (electricity/productivity/entertainment), and most recently, the dot-com boom of the late 1990’s and the COVID-fueled tech bubble of 2021 (internet/connectivity/software).

Transportation, the internet, and electricity are about to be joined by a newcomer: artificial intelligence (AI).

I wrote about how bullish I was on investing in AI back in 2020 before large language models were commonplace.

I started using ChatGPT last year and haven’t shut up about it since (just ask my friends and wife).

Not using artificial intelligence tools in life will be like not using a calculator in math class. Sure you can do it, but almost no one will because it will be impractical and put you at a disadvantage to everyone else. Just like foregoing those other technologies would severely diminish your ability to navigate the complexities of the modern age.

Here’s a few ways I’m currently using AI:

- Writing macros in Microsoft Excel and Power BI.

- Checking grammar of my articles in Grammarly.

- Responding to messages in various text platforms like Teams and Outlook.

- Copy and pasting full articles and prompting ChatGPT to summarize them.

- Brainstorming new ideas for my part-time freelance writing.

- Learning new concepts with real-world examples.

- Creating recipes by entering ingredients we have on hand or what we are in the mood for.

- And, of course, making haikus:

And here’s a few ways AI will benefit us all in the very near future:

- Healthcare diagnosis (why rely on the narrow and biased opinion of one doctor when you can have the knowledge of millions of pattern-detecting and cutting-edge AI doctors?)

- Accidents and emergencies (Apple already incorporates fall and crash detection into every iPhone and Apple Watch which calls 911 for you when it recognizes a sudden and severe impact, as well as ECGs for heart monitoring, and blood pressure monitoring.)

- Language processing (Google Translate has been embedded into earbuds to translate speech in real-time.)

- Autonomous vehicles (AVs are taking longer than expected but are already on the road and the benefit should be clear to anyone who has been sitting in agonizing commutes to and from work for most of their adult lives – hand up.) Elon Musk is content to sell his cars for 0% profit in order to yield tremendous economic advantages in the future through autonomy. I’ve written before about how Tesla is playing the long game.

- Personalized learning (AI can support personalized learning experiences by adapting educational content and methods to individual students’ needs and learning styles. Intelligent tutoring systems, adaptive learning platforms, and educational chatbots are just a few examples.)

- Energy efficiency and environmental impact (Nest already learns from your behaviors and adjusts the thermostat to be on the most efficient setting given your schedule. As electric utilities adopt more automated demand response activities to manage peak load times, they will rely on AI to predict high demand in advance to ensure stability in their grids.)

There’s also a thousand other use-cases for AI being cooked up right now in the minds of entrepreneurs and blue chip companies around the world.

But you don’t need to join the impending bubble in AI-related stocks to earn a return on this new technology.

In gambling, “table stakes” refers to the minimum amount of money required to be on the table in order to participate in a particular game. It ensures that all players have a basic level of commitment and can actively participate in the game. I believe there’s a parallel concept at play when it comes to investing.

Almost every company in the world uses and benefits from some form of electricity, transportation and the internet, and it seems like a foregone conclusion that they will all use AI very soon, too. Listening to 2023 quarterly earnings calls over the past few months confirms this. The terms “AI” and “artificial intelligence” continue to be mentioned at an exponential rate.

Tim Cook told investors they are weaving it into every single product they make. Nvidia was described as being the “only arms dealer in a worldwide war”. And Meta is almost back to being at all-time highs due to their less-well publicized investments in AI over the last few years.

Artificial intelligence will become table stakes in the 21st century. Having an AI strategy will represent the minimum level of technological integration required for businesses to remain competitive in their respective markets.

Now, I want to explain why investing in diversified index funds instead of single companies is the best way to invest in the coming revolution and take advantage of the table stakes every company will need to bring.

Investing in single companies is akin to placing all your bets on a specific technology or a handful of companies within a particular industry. This approach can be risky because the success or failure of a single company or technology can significantly impact your portfolio. And companies fail all the time. Just ask me three years ago.

On the other hand, investing in diversified index funds represents a strategy that aligns well with the fact that every company will eventually benefit from a new technology such as AI. This strategy aims to capture the overall growth and progress of the market rather than relying on the performance of individual companies or technologies.

By investing in diversified index funds, you essentially invest in a basket of companies representing different sectors and industries for an incredibly low fee.

Winners rise to the top and copycats come in to displace the incumbents. Those huge profit margins compress and the ultimate value accrues to the overall market. Why not own it all?

There’s no need to try to pick the winners this early on in a new market. It’s really hard to do consistently anyways. Just buy the S&P500 or the NASDAQ.

You’ll also have the comfort of knowing that the biggest and best companies in the world will also be involved in a ton of other revenue generating pursuits while they figure out how to incorporate AI into their many products and services.

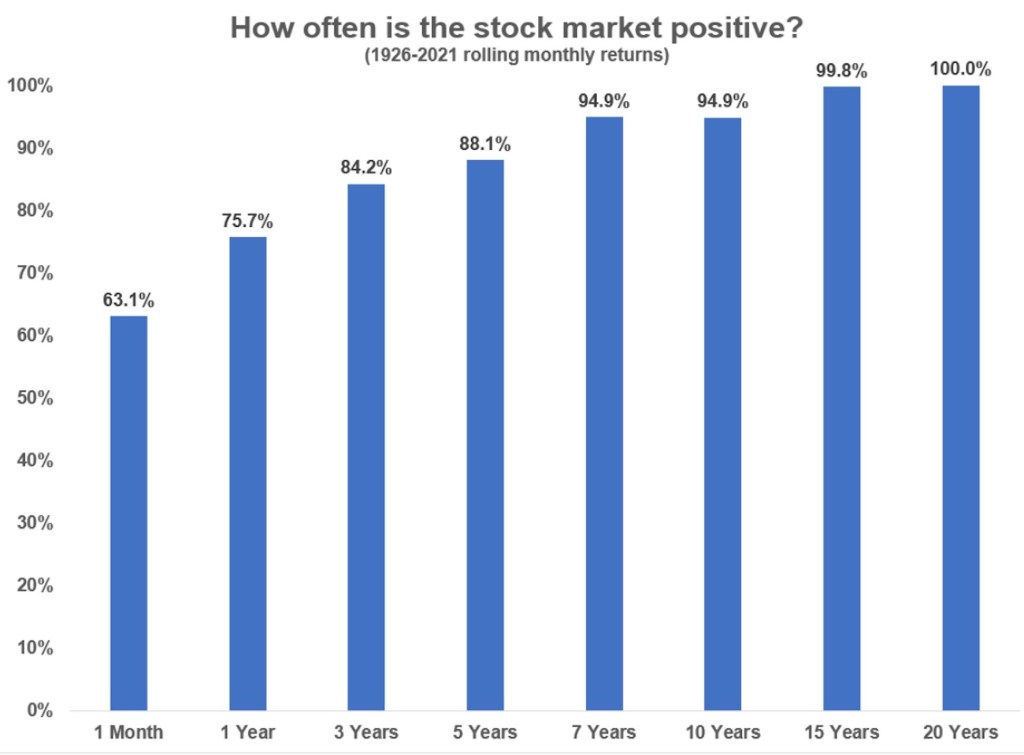

The overall market is pretty good about doing this consistently over time:

The chart above is the closest thing to a guarantee you’ll get when investing. That’s how I’ve landed on index funds. They aren’t sexy and they aren’t fun to discuss at dinner parties. There’s no prestige. There’s no bragging rights. But they work.

This is how you can invest in AI without investing in AI. Invest in the ingenuity of the best and brightest minds all around the world. Invest in potential. Invest in the relentless machine of human progress and our innate desire to improve our lives.

Subscribe below to be notified of each monthly article from http://www.poorchoices.org:

What Is a Buyer-Agent Agreement – And Why It’s the Smartest Move You Can Make When Buying a Home

Buying a home is too big of a decision to go it alone or leave it to chance. That’s where a Buyer-Agent Agreement comes in.

Keep readingKeeping Up with Yourself

Keeping up with yourself can be a great fuel—and an even greater trap. The art is knowing when to press forward, and when to simply be where you are.

(5 min read)

Keep readingWhy You (and I) Need a Career Coach

I messed up at work but survived — thanks to my career coach. Spoiler alert: British football analogies included.

Keep reading

You must be logged in to post a comment.