Money is good for one thing and one thing only: spending.

The only reason it has value beyond the paper it’s printed on is the fact that other people want it.

In order for them to get it, you have to spend it.

Unsurprisingly, the amount of money you have to spend is typically equal to the amount of money you earn.

But there’s a little secret that allows you to spend more than you earn.

Most people want to pretend it’s some big, complicated topic that you can’t understand. They pretend it’s an exclusive club with a secret handshake that you can’t learn. These people call anyone who isn’t them “dumb money”.

But, of course, you already know the secret and you are in the club and the only thing dumb is how easy it is.

The secret to spending more than you earn is investing a little bit of your paycheck over and over again and waiting long enough for it to grow into a great big pile that you can dive in to.

However, you must make this entire process automatic because investing is simple, but it is not easy.

It’s not easy because you have to remember to do it.

It’s not easy because it feels risky.

It’s not easy because of all the doomsayers on the news and scary financial headlines about recessions and housing bubbles and that whole industry of people in suits talking about how frothy the market is or how it’s become detached from the fundamentals and how “you’d be absolutely crazy to buy at these prices”. This is what supposedly “smart money” says.

If they’re so smart, why didn’t they buy before prices were so high and why aren’t they selling everything now?

Never mind the fact that those “smart” investors warning you of an imminent market collapse in every other headline have no idea what your investing time horizon is, what your goals are, or what you are investing in.

But if you make it automatic and diversified, you become the smart money.

You take all the remembering and second-guessing and willpower and regret and anxiety out of the picture. Those are all the things that make investing hard. The human things.

Thankfully, you can easily automate your investing in a number of ways.

First, and most widely available, you can use a 401(k) or 403(b) retirement account from your employer and set a tiny percentage (aim for 10% but I’ll settle for 5% if you insist on being difficult) of each paycheck to go directly into whatever fund they set you up with, which will most likely be a standard target-date fund.

It happens automatically every time you get paid, and you don’t even notice it because it happens in the deep, dark abyss of your accounting department in a process known as “payroll deductions”. This is also where taxes and health insurance fees live. Best not to look.

No 401(k) from your work? No problem.

Every single person in America has the ability to open an individual retirement account (cleverly called an “IRA”).

By setting up a recurring transfer from your bank account into your IRA each month and choosing a simple index fund, you can automate the entire process here as well.

An “index fund” tracks an “index” like the S&P 500 or the NASDAQ 100. People who pay a lot of attention to the markets say what stocks go into each index and so as long a you choose one of the big, well-known ones, you’ll be fine.

Don’t want a boring IRA because it sounds like a lot of paperwork and who even thinks about retirement anyways? No problem.

Ever since the invention of the “shareholder” by the Dutch East India Company back in the 1700’s, any person with a dollar to their name can open up an account with a bank (called a brokerage) and simply buy whatever stocks they want and sell them whenever they want.

Related:

An Open Letter to the Dutch East India Company

It’s the only place I know where the longer you stay, the wealthier you become. I can’t say the same for Target, the strip club, or any of my trips to a casino.

(4 min read)

Again, you must automate this if you are to succeed.

Brokerages (banks) make it very easy to automate the process, too.

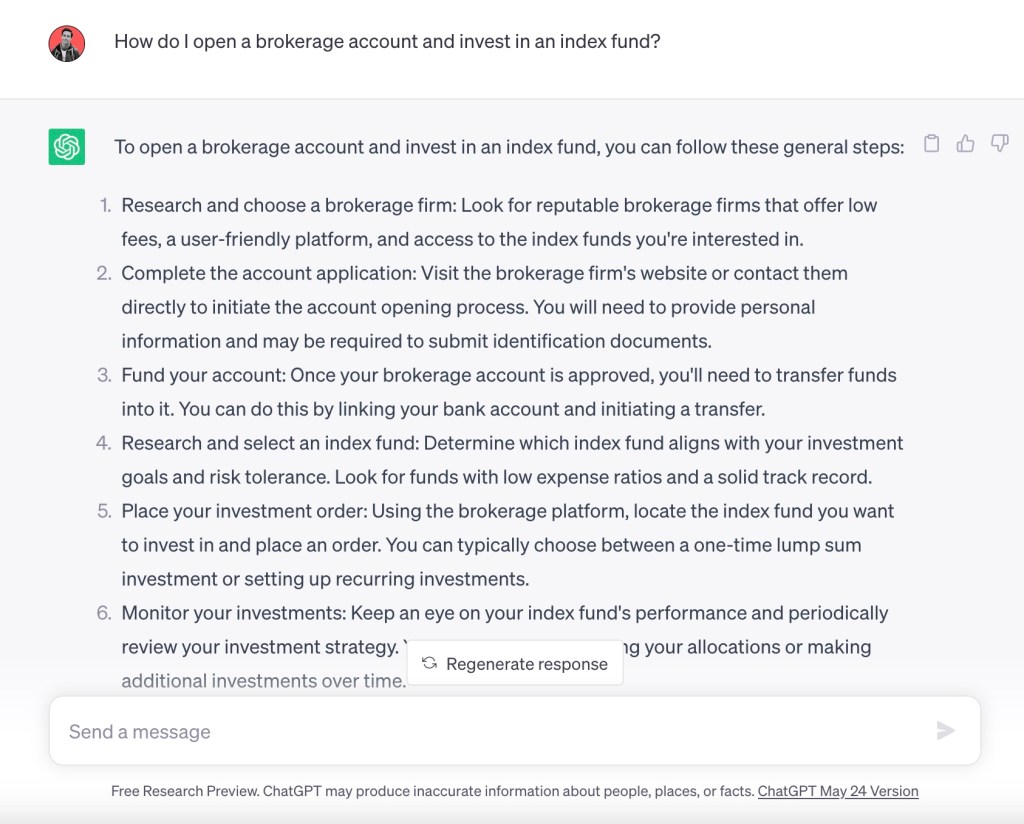

In fact, this whole process is easy. You could literally Google “How do I open a brokerage account and invest in an index fund?” and you will get no less than 28,900,000 results (in 0.44 seconds).

Of course, this isn’t 2002 and no one uses Google anymore. Instead, you can ask ChatGPT and here is what it will tell you:

Simple. Just not easy.

However, if you automate the process and if you let it sit around long enough in the right places, you will eventually have far more than you earned originally.

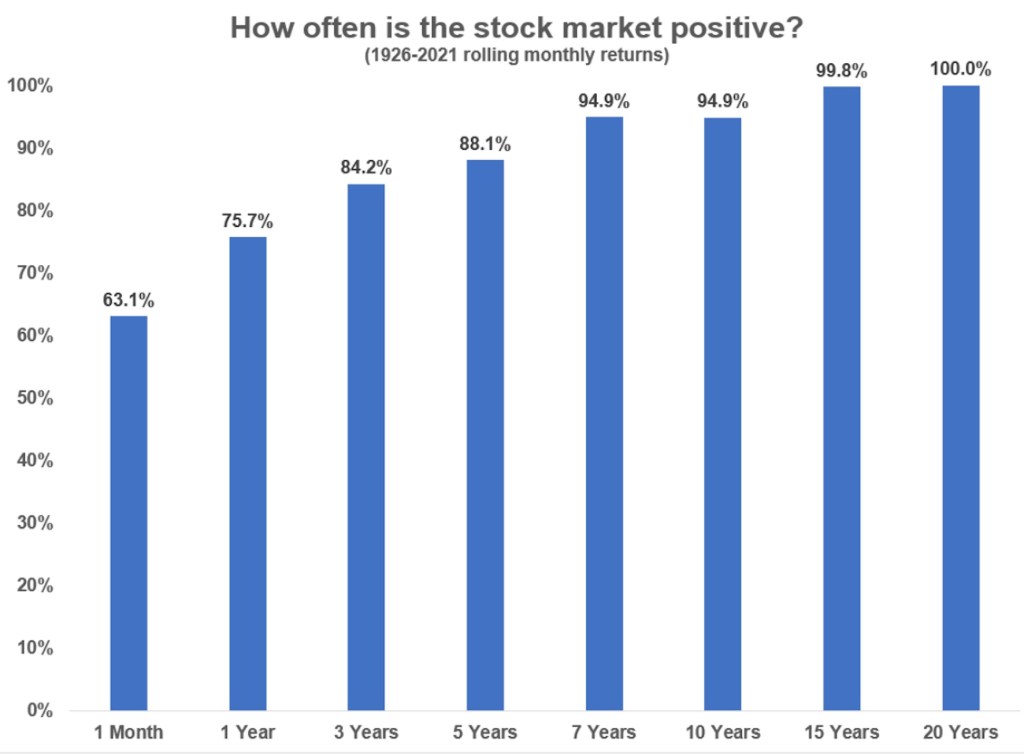

But how long is “long enough”?

Statistically speaking, “long enough” is about 15 years according to this chart, which shows the stock market has never lost you money if you hold your investments for at least 15 years:

There are plenty of shorter time periods that have also resulted in positive gains. Fifteen years is just the closest thing you can get to a guarantee of a return.

And again, the “right place” is somewhere diversified enough to reduce your risk.

Single stocks are risky. Index funds are typically much safer because they spread the risk out over hundreds or thousands of companies and business models.

Index funds also allow you to invest in new technologies like AI and electric vehicles and virtual reality without the risk of a single company going bankrupt.

You need to diversify across both place and time for this secret to work.

Having an automated system for this whole process lets you forget all about investing. You can go out and spend your time on the things you love like flying coach on Spirit, leasing your Kia, and ordering appetizers at Olive Garden.

And one day you’ll wake up with more money than you can believe. Enough money to fly coach on Delta, lease a Toyota, and order appetizers at Olive Garden.

But if none of this has convinced you that investing is your cup of tea, you should at least make sure you are earning a good interest rate on the cash you have sitting in your bank account. This is another secret that most people don’t know but is a super easy way to earn more money.

Most banks and savings accounts today give you about 0.42% interest on the balance you keep there. So if you keep 1,000 dollars in the bank for one year, they give you about $4.

That’s low because they also need to pay for the building and taxes and the tellers and all those ATMs around the country.

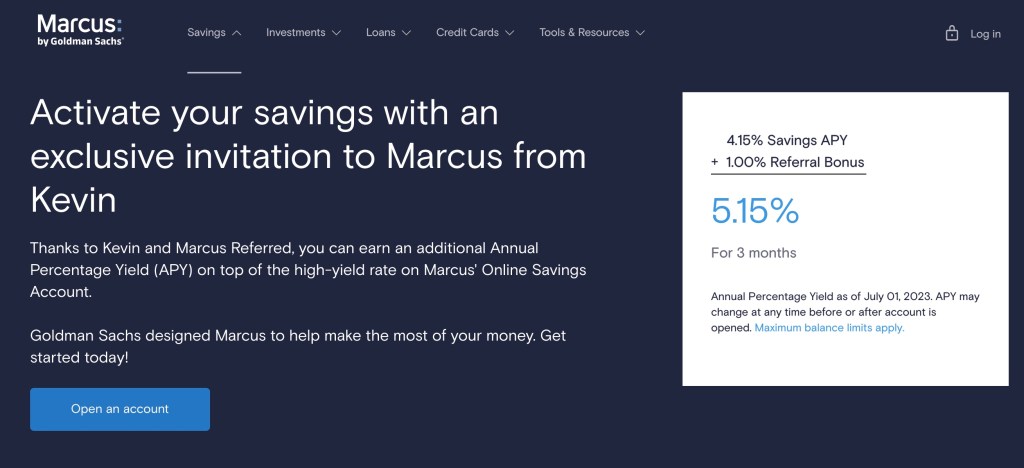

But if you find a reputable online bank, you could earn about 10 times more in a “high-yield savings account”. I use Marcus Goldman Sachs and earn 4.15%. This means that if I keep $1,000 in my online savings account for 1 year, Goldman Sachs gives me $42.

And $42 is exactly the cost of two entrees and an appetizer at Olive Garden. Now you see the true power of high-yield savings accounts.

If you don’t have an online savings account, I strongly urge you to open one. I can even help you.

Notice how there’s no annoying ads on this website? That’s because I have them turned off. I don’t earn any ad money for all the blood, sweat, and tears I put into this advice. It’s all free (and worth about the same). That’s because when you’re here, you’re family.

And if you use my referral code, you can earn an additional 1% on top of what Marcus Goldman Sachs normally pays for the first 3 months and I get the same benefit:

With a savings account like this, you can get a Tour of Italy any time you want (the entree, not the real thing).

Whether you want to invest or simply put your cash in a smarter place, automating it is the single best kept secret in behavioral finance.

As you can see, all roads lead to spending, but some roads lead to spending a whole lot more.

More reading:

One Trip Now, Two Trips Later

Why do people travel?

To become more cultured. To see more of the world. To break the monotony of day-to-day life. To post photos online in an attempt to give their friends FOMO. To create memories.

All good things.

But unless someone else is paying for your travels, you can only travel as…

Don’t Sleep, There Are Snakes

Thinking about the world in a different way is almost impossible, especially as we get older.

Four lessons on finance and life from a culture very different than your own.

(5 min read)

7 Lessons in Personal Finance from The Weasley Family of Harry Potter

7 evergreen lessons on personal finance from one of the most important wizarding families to ever live.

You must be logged in to post a comment.