There’s no shortage of scary, awful, pessimistic headlines in the news right now. This has always been true because good news doesn’t sell.

“If it bleeds, it leads,” journalists say.

The most clickable headlines are written to stoke fear, outrage, anxiety or some combination of these. Click the headline, share it incredulously, and on and on while everyone is served up more ads.

This is what makes investing so hard.

Investing your hard-earned money requires a belief that things will get better. Unfortunately, entire industries are built on the belief that things have always been bad and will only continue to get worse.

Pessimistic people even sound smarter.

They sound like they are helping you avoid something disastrous.

Occasionally what they are saying could end up being true. Like when someone is warning you not to eat Taco Bell before getting on an airplane. But most of the time, it isn’t. And the problem lies in that “most of the time” space.

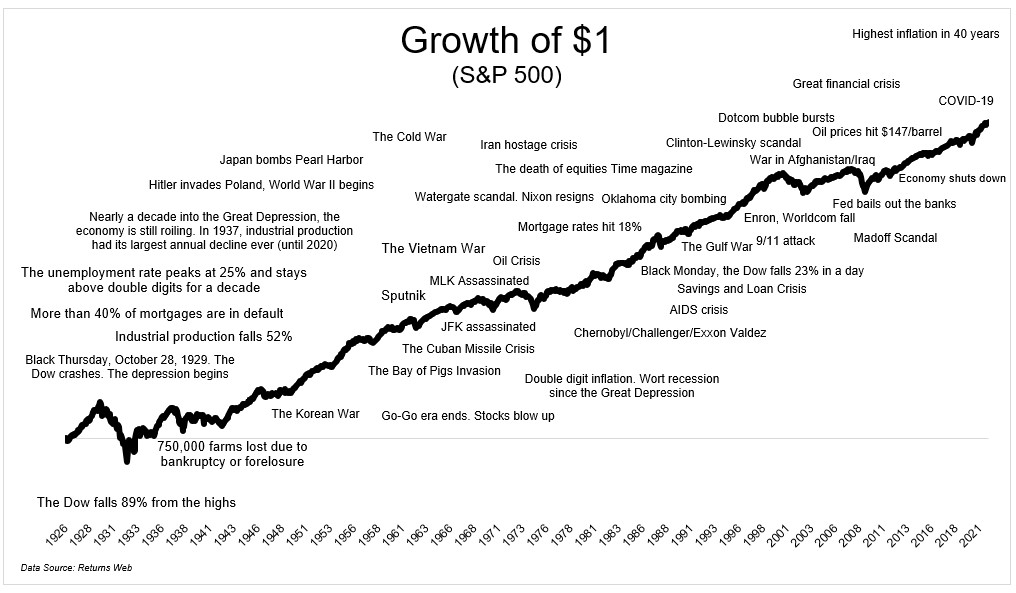

The stock market is positive 75% of the time. But it’s not a train schedule. It can be positive every year for a decade straight and then experience a crash or correction for 3 years straight. Should you wait a decade and forego a 200% gain only to save yourself from a 30% decline? Of course not.

And even when it is negative, there’s no telling how negative it will go or how long it will stay negative so jumping in and out of cash and stocks at the right time is impossible.

Therefore, someone warning you the market is overpriced, or frothy, or due for the crash of a century is not your friend. And the best part for the doomsayer is they can always say “just you wait”. They can never be proven wrong.

Unfalsifiable claims are their body armor.

But even if they were correct one year, they would need to follow up their lucky prediction by telling you when to invest again after you sell all your positions.

How?

Maybe they’ll text you?

Or maybe massive media conglomerates and billionaires that love the lime light don’t have your best interests at heart.

I get it, though. It is objectively painful to invest if you think about it too much.

Investing causes anxiety because anxiety stems from not knowing what may happen in the future.

Or if you invest at the wrong time and the market goes down, you may get depressed because depression often stems from thinking about past mistakes. The feeling that nothing will get better.

Neither of these are fun experiences even though it is certainly statistically better for you to lean into the discomfort:

Investing when the market is crashing (or may crash) requires a belief that any pain you experience in the short-term will be washed away over the years and you will eventually be rewarded.

Sometimes short term pain needs to be experienced in service of the greater good (financial security, independence, and the ability to take two vacations for the price of one).

There are other kinds of pain that can result in an overall positive impact on one’s life, too.

Just look back on a difficult moment in your own life where you found yourself outside of your comfort zone. You were likely experiencing some form of psychological or emotional or even physical pain that may have ultimately resulted in a good thing.

Here are some examples:

Soreness

Waking up two days after a tough exercise can sometimes be painful. During the exercise, the muscle fibers were torn a bit in order to regrow bigger and stronger.

Marcus Aurelius talked about this when considering that if you use your hands and feet all day, they will naturally be sore, and you should welcome this as it is proof that you took action rather than wilting away.

Use your body. Lift heavy things. Elevate your heart rate. Become winded. And when you wake up sore, smile, because it is proof that you lived.

Boredom

Reading long books can be agonizing. Reading paper books rather than reading on your phone can be doubly so since there is no option to flip to a more exciting app. But there are benefits in being able to persevere through long stretches of low stimulation.

It can be especially tough when you feel as though you aren’t retaining anything you read. One tactic to remedy this is to try asking yourself a single question that you believe can be answered by reading the next paragraph or page. This will engage your mind. Before you know it, you’ve learnt something new as the momentary drudgery gives way to lifelong knowledge.

Loss

While it can be heart-wrenching to lose someone close to you, it often prompts two things: the desire to live a more examined life, and an urge to connect more with those who are still alive.

Call your parents. Invite your friends for dinner. Send a text to someone who least expects it.

Imposter Syndrome

Starting a new job can be a stressful undertaking. Switching roles or industries can be extra difficult. But sometimes it is necessary. In particular, it’s necessary if you aren’t getting enough value out of your current situation.

I look for career value in four areas: purpose, income, growth, and community:

Purpose. Purpose need not come from a career you are passionate about. Purpose can come from being an expert, having the freedom to work autonomously, or simply a job well done. But it’s essential to a happy work life.

Income. If you don’t feel as if you’re being paid adequately, and you’ve used my 5 tips on how to ask for a raise, it’s time to update your resume.

Growth. Just like a muscle which is never used, your skills will atrophy when you’ve become too comfortable at a job. If you are no longer growing in your role or your company, it’s a good signal to start looking elsewhere.

Community. If your colleagues and managers are toxic or inept, it may be time to move to a healthier situation.

If you do decide it’s time to move on, prepare yourself for the pain that comes with feeling like an outsider. It takes a long time to earn the trust, respect, and comradery of a new work tribe.

You may question your decision and want to return to your old place of work. But if there’s no red flags at your new job, push through and you’ll be rewarded with a more satisfying way of spending 40 or more hours of your life each week.

FOMO

More relevant every day is the initial pain of quitting social media. Not just deleting the apps but actually deleting your accounts. You may initially feel as though you’re missing something, when you’ve actually gained so much more.

A simple test is to spend 15 minutes using any social media app you like and ask yourself if you received a net benefit from that time. If the answer is yes, then, keep using.

It will always be entertaining as you scroll past funny memes and wedding photos, but if you feel less like a human and more like a mouse pressing a button for dopamine hits over and over again until it dies, it may be time to quit.

Even casual users are beholden to the red notifications, the deluge of highlight reels, and the constant self-comparison.

Studies show that the “Yeah I have an account, but I don’t post anything” crowd are actually worse off, too. Instead of participating, these users are mere voyeurs into the endless narcissistic broadcasts of other people’s lives which leaves them feeling worse than if they actively participated.

The term “users” is telling.

I wrote a review of the Social Dilemma here. It’s worth a watch if you want to learn more about the potential damage being caused. Social media is our generation’s version of cigarettes.

In each of these examples, as with investing, there is pain in the moment, but you’ll yield great benefits over time by leaning into it.

More Reading:

What Is a Buyer-Agent Agreement – And Why It’s the Smartest Move You Can Make When Buying a Home

Buying a home is too big of a decision to go it alone or leave it to chance. That’s where a Buyer-Agent Agreement comes in.

Keeping Up with Yourself

Keeping up with yourself can be a great fuel—and an even greater trap. The art is knowing when to press forward, and when to simply be where you are.

(5 min read)

Why You (and I) Need a Career Coach

I messed up at work but survived — thanks to my career coach. Spoiler alert: British football analogies included.

You must be logged in to post a comment.