The market is down about 17% over the last six weeks. When I say market, I mean the S&P 500, the most widely accepted proxy for the performance of the U.S. Stock Market.

Anyone regularly investing through a 401k at work, or a Robinhood account on their phone, or an IRA with any of the big trading firms (Fidelity, E*Trade, etc.) is likely well aware of this. Whenever financial headlines get mixed in with the general news headlines you know something is happening.

That something is tariffs announced by the Trump administration and now by other countries in response.

It makes sense. Tariffs are basically just taxes on products.

When one country (the US) puts a big tariff (tax) on the product of another country, the cost of the product will go up. When prices go up, demand goes down. When demand goes down, companies sell less. When companies sell less, their earnings go down. And earnings per share (EPS) is a common way a stock, and therefore the stock market, gets valued.

Now that we’re all on the same page, I want to remind you that unless you are actively withdrawing from your retirement accounts, this is a good thing.

Setting aside the risk of a complete global economy collapse, when the stock market drops a lot, you should be happy. Besides, if the global economy collapses, there are bigger concerns than the value of your portfolio. But that’s unlikely. It just happens to feel bad in the moment.

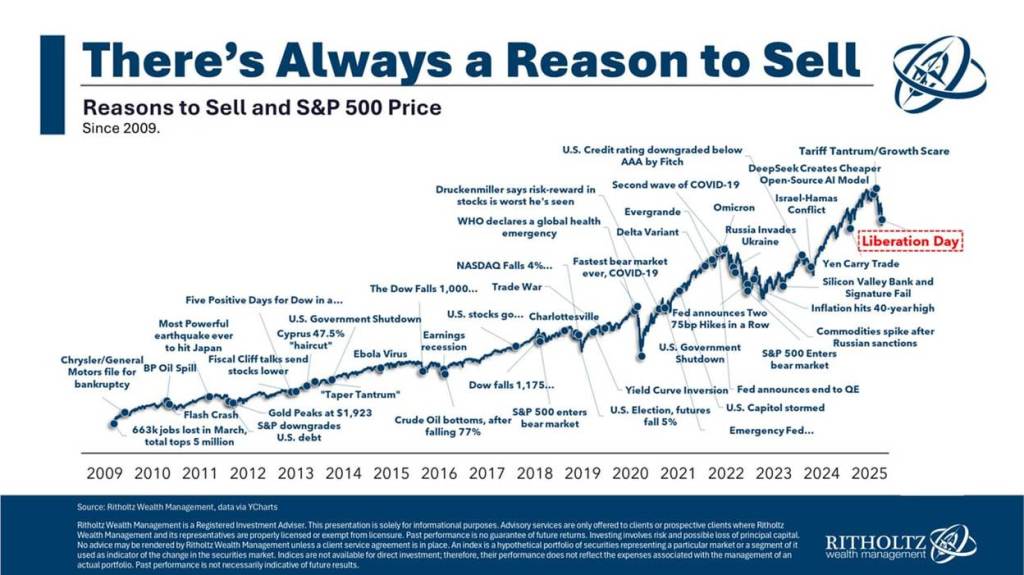

Michael Batnick over at the Irrelevant Investor has this great chart of all the times things felt bad or scary over the past decade:

This should help you zoom out past the day-to-day headlines. In doing so, you can clearly see it has paid to lean into the pain in recent years.

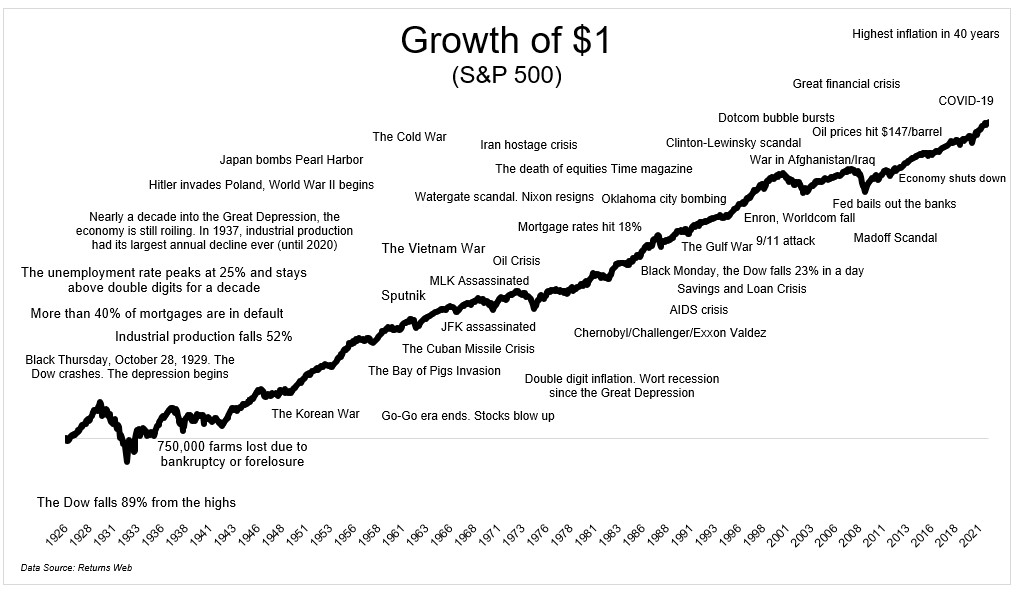

If we go back further in time, we find more of the same:

But let’s set aside the stock market for a moment and focus on YOU.

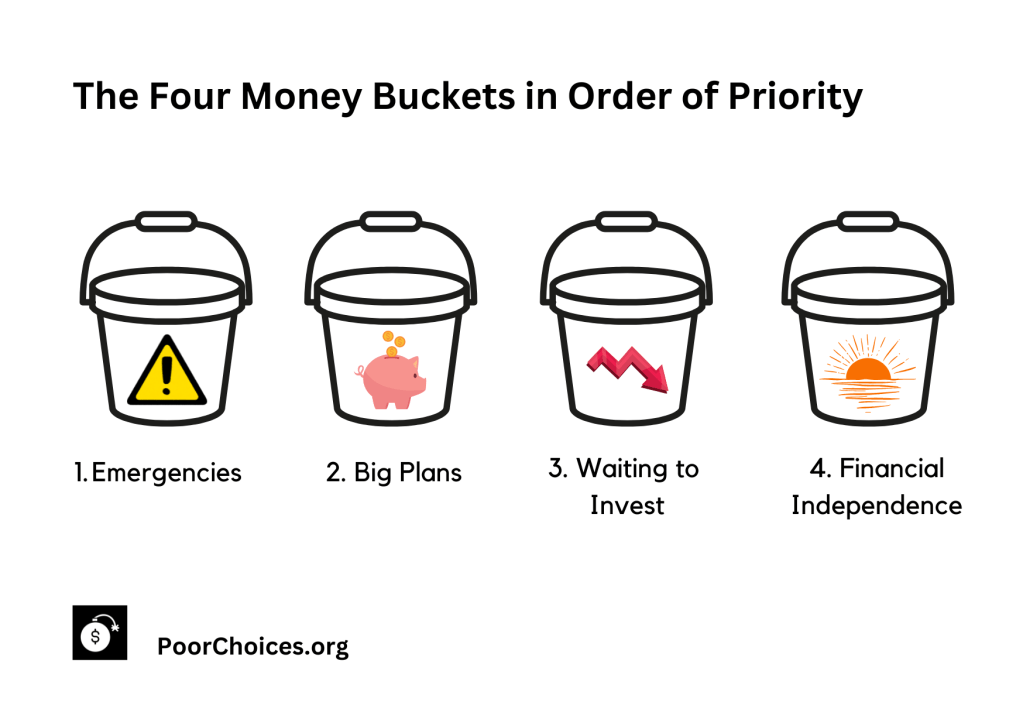

There are three (or possibly four) different buckets of savings YOU should keep at all times.

Note: this excludes any money you keep in a checking account for your monthly expenses:

Bucket One: Emergencies

- Always have 6 months of living expenses in cash in an emergency savings account. Preferably a savings account paying you interest.

- If you don’t have one, what are you waiting for? Feel free to use my referral code to open a high-yield savings account. We both get a little boost out of it.

- Park this cash and don’t touch it unless you get fired and need it for food and rent.

Bucket Two: Big Plans

- Always keep your savings in cash for any big, planned purchases coming up like a wedding or a house or a dozen eggs.

- Don’t touch it until you need it.

- Don’t invest it.

Bucket Three: Waiting to Invest

- This is an optional savings bucket for people that like to set aside cash for downturns in the stock market.

- I like this approach and use it but it is medium risk, medium reward. The risk is the stock market doesn’t drop for years on end and I sit in cash for too long, earning less than the stock market would have paid over that time. The reward is sometimes the market does crash and I get to invest at lower prices than I otherwise would have.

- However, this requires three things: 1) paying attention to markets, 2) knowing when to buy, and 3) having the fortitude to buy when every bone in your body is telling you not to.

Bucket Four: Financial Independence

- The Financial Independence bucket is the end-goal of all your hard work over many years. This bucket includes your general investments, retirement accounts like 401ks and IRAs, and stock trading accounts. Ideally, these are the accounts you have set up to auto invest directly from your paycheck every couple of weeks.

- The only time you should be taking money out of this bucket is if you have reached Financial Independence and you are no longer working (aka retirement, or some version of a life where you aren’t worried about your job to support you).

Okay, got your savings buckets straight? Let’s flip back to the markets.

Ideally, you invest everything from bucket three into bucket four at times like these. This is known as buying the dip.

Most people get scared and sell the dip. But you’re not like most people. You read poorchoices.org. Well done.

Ten or twenty percent market crashes always feel bad in the moment but they are often the best time to buy. It’s like magically being allowed to travel back in time and invest money you didn’t have available back then.

But the trick here is not to wait until the dust settles. The dust never settles. In fact, the “unsettled dust” is precisely the risk you are being paid to take. If there was no risk (no dust), there would be no reward.

However, if the current drop of 20% makes you think another drop of 20% is right behind it, fine, I give you permission to only invest half of bucket three now. Save the other half for if and when a second drop comes. And if it doesn’t come, you won’t have missed out on all the gains and you will have slept well at night, too.

The stock market isn’t some scary, complicated place reserved only for Wall Street professionals. It’s a reflection of the smartest people around the world at the best companies working like hell to make things better, cheaper, and faster for your convenience and for their own self-interest.

But in moments like these, you just need to close your eyes and jump.

More reading:

What Is a Buyer-Agent Agreement – And Why It’s the Smartest Move You Can Make When Buying a Home

Buying a home is too big of a decision to go it alone or leave it to chance. That’s where a Buyer-Agent Agreement comes in.

Keeping Up with Yourself

Keeping up with yourself can be a great fuel—and an even greater trap. The art is knowing when to press forward, and when to simply be where you are.

(5 min read)

Why You (and I) Need a Career Coach

I messed up at work but survived — thanks to my career coach. Spoiler alert: British football analogies included.

You must be logged in to post a comment.