Food prices are high out there.

Wages for workers in the food industry have been rising at a fast rate.

That’s a good thing, but restaurants and grocery stores have been raising their prices in response and passing those increases onto us as consumers.

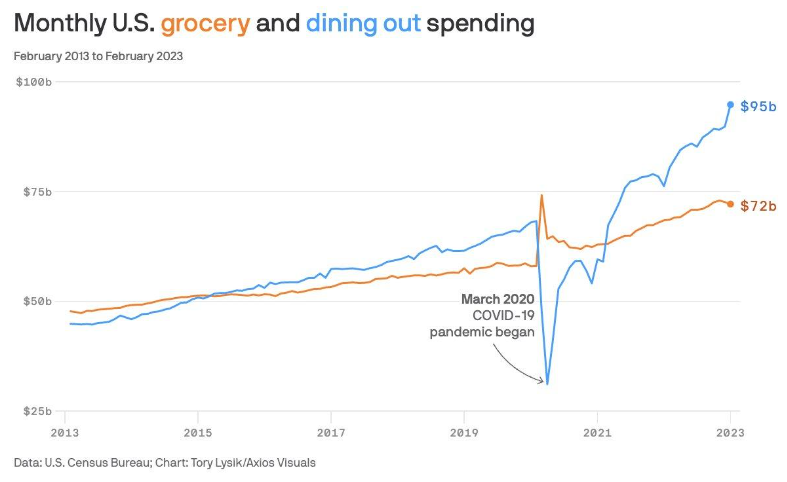

Here’s some recent data:

If you’re like me, you’re constantly looking for ways to save some green on your greens. Keep more cheddar in your pocket. Ride the gravy train down easy street.

You’d think one food-related pun about money is enough. I’m compromising with three.

I’ve been manually tracking every penny I spend for the last decade so I have some annual food price data of my own:

And, yes, I actually track every single penny I spend in a spreadsheet I’ve had for over a decade.

Now, you might think to yourself, “Wow, someone who tracks their spending so closely must know a lot about saving money and must be really cool, too.“

Half right you are, my friend!

Of course, none of my data is controlled for variables like learning I value the ethics of free-range eggs more than the added cost, but you get the point.

If I can keep my food spend relatively flat, even while the quality and sustainability of my food choices has gone up, you can, too.

Below I share my 10 favorite tips for saving money eating out or at the grocery store.

Pick and choose what works for you and even the odds against Big Food:

Tip #1: Treat Eating Out as a Treat

The act of going out to eat was always an event in my household. Usually reserved for birthdays or celebrations of some kind. By keeping it reserved for special occasions, not only did it mean more upon recalling it from memory, the experience was richer during, too.

These days, my wife and I use our monthly date nights as the special time set aside to try a new restaurant or frequent a trusted favorite. Since we don’t eat out every week, this leaves us free to order a drink first or grab dessert afterwards completely guilt-free.

Tip #2: Meal Prep

I know. It’s a pain in the butt to plan meals and buy the ingredients and make the food and do the dishes. But it will save you a lot of money in the long run.

I’m using the term “meal prep” loosely here. Meal prepping sometimes implies measuring out calories or using lots of Tupperware.

I’m not referring to all that. I’m just referring to having a plan for your week’s meals. Here’s an example from my super exciting life:

We sit down on Sunday morning and write out a grocery list. We toss out a few ideas for meals we want for lunches and dinners for the coming week.

For lunches, it’s usually something easy like turkey and avocado sandwiches or burrito bowls.

For dinner, we try to have a protein, a veggie, and a carb. Chicken, rice, and broccoli is a staple in our house.

We make the first dinner Sunday night with enough leftovers to get us through Tuesday. Then on Wednesday night we make the second dinner we planned. Some other protein, some other veggie, and some other carb.

Variety is good. If the weekend rolls around and we don’t have enough food left, we order takeout (using tips #3 and 5 below). No overspending. No problem.

Say one single serving meal at a restaurant costs $15. I can make about four servings for the same price. And it’s healthier, too.

Over time, this approach saves us a lot of money and still allows us to enjoy a pizza night.

Speaking of pizza and now that your mouth is probably watering…

Tip #3: Go Pick it Up

Skip delivery whenever possible. I grew up working at a pizza place. Not only did we charge a lot more for delivery, your pizza sat around after it came out of the oven while the driver waited for a second order going in the same direction.

And you have to tip, too. (There’s a special place in hell for people who don’t tip delivery drivers.) You get worse food for more money.

This applies to almost all forms of delivery, from pizza to groceries to shrubs. I needed 16 tall shrubs to plant around our yard. Delivery was $100. So I drove down the street, rented a truck from Home Depot for $20, looped back and picked them up myself.

The whole process took just under an hour. That’s like paying myself $80/hour which I can assure you I don’t make at my day job.

There is a time and place for delivery. If you’re sick and can’t leave the house, use Instacart for some NyQuil and Gatorade. If you are hosting and ordering delivery so as to not disrupt the evening, go for it.

But ordering delivery on a regular basis becomes lifestyle inflation.

Speaking of food delivery apps…

Tip #4: Beware the Fake Deal

Services like Hello Fresh and Door Dash spend a huge amount of money on customer acquisition marketing.

They offer steep discounts for your first time using the service, only to hike the price way up once you’re a repeat customer. You’ll likely forget to cancel anything that has a recurring fee, too, because it’s hard to find on their website.

They know this; their business model relies on it. Use with caution.

Tip #5: Use the Drive-Thru Apps

Who doesn’t love crispy chicken nuggets from Wendy’s or a steak quesadilla from Taco Bell every once in awhile?

Don’t forego these devilish delights.

Instead, use the apps that these drive-thru companies have. Using an app provides two benefits:

- There are often “Deals” or “Offers” in the app. For example, buy one sandwich, get a second free.

- You can take your time placing the order and not get rushed into picking something too quickly. I don’t know about you, but I hate standing in line with a cashier staring at me and a line of people behind me when I’m ordering my food. Too much pressure.

Tip #6: Embrace the Coupon

There’s been more than one person that looks at me like I’m crazy when I tell them I use coupons. You’re likely picturing someone sifting through stacks of newspapers, hoping for one measly $0.25 off coupon for a can of beans they weren’t even planning on buying.

That’s where people have it wrong.

National grocery chains want you to keep shopping at their stores, especially when competitors are in the area. So they will often send you personalized coupons in the mail or print them out at the register.

To the uninitiated, this looks like junk mail or trash. But in reality, they are basically printing money and giving it to you for the things they know you like. Happy customers come back.

Other chains, like Kroger, use digital coupons tied to their app and your loyalty card number. When items I buy every week go on sale with digital coupons, I tend to buy extra if it’s not perishable.

One of my favorite coupons is the “Spend 100 dollars in a single visit, save $10” or some variation of that. When that coupon rolls around, I simply follow this next tip:

Tip #7: Buy in Bulk

No Costco membership required.

“Buying in bulk” is simply about buying the largest package of an item assuming you have space for it and it doesn’t expire, like paper towel or razor blades.

Even if it does expire, you can do the simple analysis in your head to determine if you’ll use it all before it goes bad for things like rice, olive oil, or protein bars.

If there are multiple sizes of an item, the largest size is often the most cost-effective. Most people understand this, but I’m going to belabor the point just in case you never learned this trick.

When you are at the grocery store looking at two different sizes of something, they will often list the price of the item, and then a smaller price below it indicating the price per weight or price per unit. It looks like this:

The larger quantity is almost always less per unit or less per weight.

For example:

- A 5-pack of protein bars costs $5 (or $1 per protein bar).

- A 10-pack of the same protein bars costs $9 (or $0.90 per protein bar).

- The protein bars don’t expire for 7 months. Will I eat all of these before they expire? Of course I will. I just saved $1.

A few additional issues with this trick besides the expiration date are storage space and up-front cost. If you don’t have enough storage space on the shelf or in a cupboard, I urge you to make the space. We spend thousands of dollars on groceries per year, so the savings can be substantial over time.

A second issue is the up-front cost. At first, it may be that you don’t have enough money to always buy the larger size because you are living paycheck to paycheck. Just try it for one or two items on your next trip to the store.

Over time, simply being aware of this fact will present you with opportunities to take advantage of it. No need to do it with everything all at once.

Combined with sales, this can be a huge money saver.

Tip #8: Buy the Store Brand

I’m sure this needs no explaining. Those in opposition of store brands swear their taste buds can tell the difference. I don’t disagree.

I’ll just say that store brands are almost always less expensive for generally the same raw materials combined at the same manufacturing locations on the same line.

I will concede that a few brand name foods do seem to taste better. But who are you? The Queen of England?

Tip #9: Meals Before Meals

Hunger is the best sauce. And there is no surer way to diminish your hunger (and therefore the size of your wallet) by ordering an appetizer while eating out.

The only time I order appetizers is when buying it as a gift for the table or when trying to impress a date. Shows of generosity for loved ones over the dinner table rank high in my book. But making it standard at every meal you eat out is a tricky habit to break.

Besides, you’ll enjoy your meal more when it comes if you’re hungry.

Tip #10: Take It Home

Most restaurants serve exceedingly large portions. And if you are eating out, you should be treating it as an experience both for yourself and the guests at your table. Shoveling your mouth full of food while ignoring the conversation of the table is not a great show of respect for the tradition.

Eat slowly, enjoy the flavors and your company, and take the second half home for lunch tomorrow.

There you have it, 10 tried and true methods for keeping more dough in your pocket. (One more food pun for good measure!)

More reading:

How to Save Money while Saving Energy

I think about saving money like a bird thinks about flying. Which I assume is never and also all the time.

So, these days, when it comes to saving money, I like to think about the amount of energy or materials that are saved in addition to the money itself.

10 Advanced Tips to Save Money

Here are ten advanced tips to save you money! (6 min read)

You Don’t Need to Invest in AI to Invest in AI

Not using artificial intelligence tools in life will be like not using a calculator in math class. Sure you can do it, but almost no one will because it will be impractical and put you at a disadvantage to everyone else. Here’s how you can invest in the AI revolution.

(6 min read)

You must be logged in to post a comment.