Cereal is great, but only a psychopath would eat a bowl of cereal for breakfast.

In fact, I’m pretty sure Lord Voldemort ate cereal for breakfast. It’s in the 5th book. Look it up.

No. True cereal aficionados know cereal is the perfect afternoon or late-night snack.

Come home from school in 4th grade and jump on the couch to watch cartoons? Cereal.

Working from home and need a break from your clients? Cereal.

Had two drinks alone at the bar and now you’re home and sad at 9pm on a Friday night because you’re 33? Cereal.

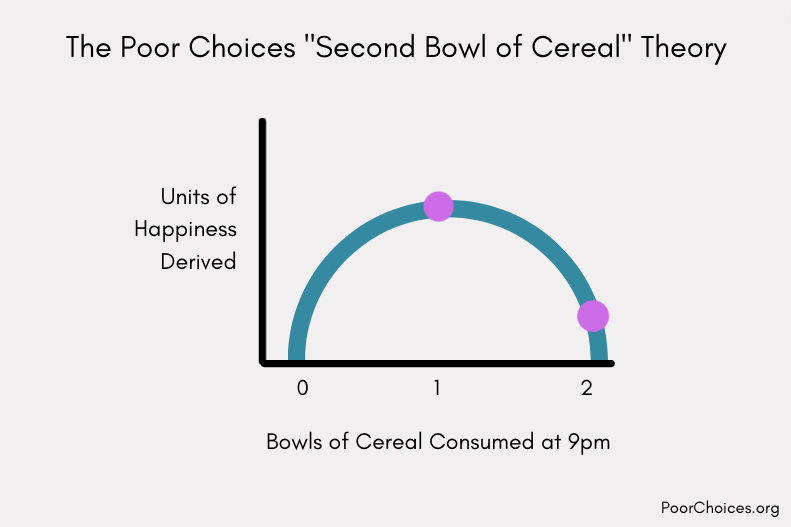

But no matter how good that first bowl of cereal is, you must never go back for a second bowl.

Its sweet siren call is like that of heat waves masquerading as an oasis far off on the horizon in a hot desert – just a mirage.

The second bowl of cereal will not only taste worst than the first, it may make you disgusted with yourself for having indulged. Or even worse, disgusted with the cereal itself! Poor cereal.

This is due to a principle called “diminishing marginal utility”. The second bowl of cereal provides far less utility (the economic term for happiness) than the first. A third bowl of cereal would just be blasphemous and we won’t even speak of it.

Diminishing marginal utility explains why a person is not willing to pay as much for the next unit of a service or good as they were willing to pay for the previous.

It’s why you don’t see a lot of “Buy one, get one half-off” deals on televisions. Once you have one, you really don’t benefit from another and the price would have to be quite low to convince you to buy it.

I think about this a lot in terms of personal finance decisions.

It’s why a bigger house doesn’t interest me. We live in a very modest two story home. Yet I have more space than I thought I’d ever have in my life. Another square foot is worth much less to me now than it was worth when I lived in a small 700 sq. ft. apartment. Now it would just be a burden because I’d have to clean more.

Reflecting on this fact whenever possible, staying grateful, and looking for this mismatch between what you once wanted and what you now take for granted is a good way to make smart financial decisions.

Leasing a car means you’ll get a new one every couple years and your lifestyle inflates to meet that new baseline. The upgrade every few years means less and less as your expectations have adjusted.

But owning your car for ten years means when you finally get a new one, you’re going to get a huge blast of utility from it.

Here are some other economic theories at play in my finances (and maybe yours, too):

Law of Supply and Demand

As the supply of something goes down and demand remains constant or goes up, the price goes up. As the supply goes up, price typically comes down.

This is why I was relatively confident buying our house in 2021 even after the run-up in prices in 2020. We’ve been under-building in the U.S. for years ever since the housing bubble broke in the late 2000s.

Builders were scarred and now they can’t outpace the number of household formations taking place.

Millennials are the largest group of Americans and they now have the money and the need to buy houses because they’re starting families. Trends can continue for a long time when demographic pressures are at play.

Not to mention there’s a severe lack of qualified tradespeople to frame the house, plumb it, wire it, roof it, and finish it.

Combined with rock-bottom interest rates that could only go in one direction (up), it makes for a shocking imbalance of low supply and high demand.

I wrote my predictions for housing prices 2 years ago and so far have been spot on (not to brag):

Are We in a Housing Bubble?

Although housing prices have risen quickly over the past couple years, and are now out of reach for many first-time home buyers, to call it a bubble would be to call it unsustainable, irrational, and driven by euphoria or greed.

No one asked,…

Opportunity Cost

Opportunity cost is, not surprisingly, the “cost” of pursuing one opportunity over another.

It can be expressed numerically or qualitatively.

For example, choosing between two different job offers with different pay may create an opportunity cost for you. If you choose a job paying $75K per year, and turn down a competing offer that would have paid $90K per year, the opportunity cost of this decision would be $15K.

Relatedly, if you accept a job in a state with a cold climate, instead of a job in a state with a warm climate, the opportunity cost of accepting your role is the value you see in living somewhere warm.

Making choices is all about tradeoffs and those tradeoffs are typically the opportunity cost of the decision.

I also think about this in terms of paying off loans and carrying debt.

I currently have a bank account yielding 4.30% interest on my cash while our car loan is a bit lower at 4%. We could pay off our car loan using the cash we have saved, but the opportunity cost would be 0.3%. This simple tradeoff is not worth it since I can make more money each month in interest (by just a sliver) than I would save by avoiding interest on the loan.

However, if the car loan was 5%, the opportunity cost would be -0.7% and I would likely pay off the loan. You can think of a negative opportunity cost as an “opportunity benefit” in this scenario.

Comparative Advantage

I remember learning about comparative advantage in my college macro econ class just when globalization was becoming a hot-button issue. I’ve thought of it in my personal life ever since.

The theory basically states that if you (or your country) can produce something better than another person or country, you should create a lot of that thing, and trade or buy the things you can’t (or don’t want to) produce very well. You have an “advantage” in an item or service “compared” to someone else.

This theory is why I don’t hang my own drywall, file my own taxes, or pour the cement for my own patio.

I am confident I could do each of those things. But, I am also confident that I would be inefficient at them and the end result would look amateurish.

When I was younger, I actually did do all of those things myself. But now I pay professionals who specialize in those services and I use my time for other pursuits where I do have an advantage such as writing this blog, reading about my industry, and working additional hours at my day job.

By focusing on those other pursuits, I am more likely to earn more money in the long-run than if I spent my time to become an expert in drywall hanging, mudding, taping, sanding, and painting.

There are still some activities where I don’t have a comparative advantage, but I still do myself such as mowing my lawn, installing a backsplash, or managing my portfolio, for example.

Even though it isn’t strictly optimal for me to do those things, there are intangible benefits I get which make them worth my time. The intangibles include exercise, peace and quiet, and independence/knowledge.

Production Possibility Frontier (PPF)

The production possibility frontier is a curve that shows the maximum possible amount of two goods that can be produced given available resources and technology. The PPF shows the trade-offs in production volume between two choices.

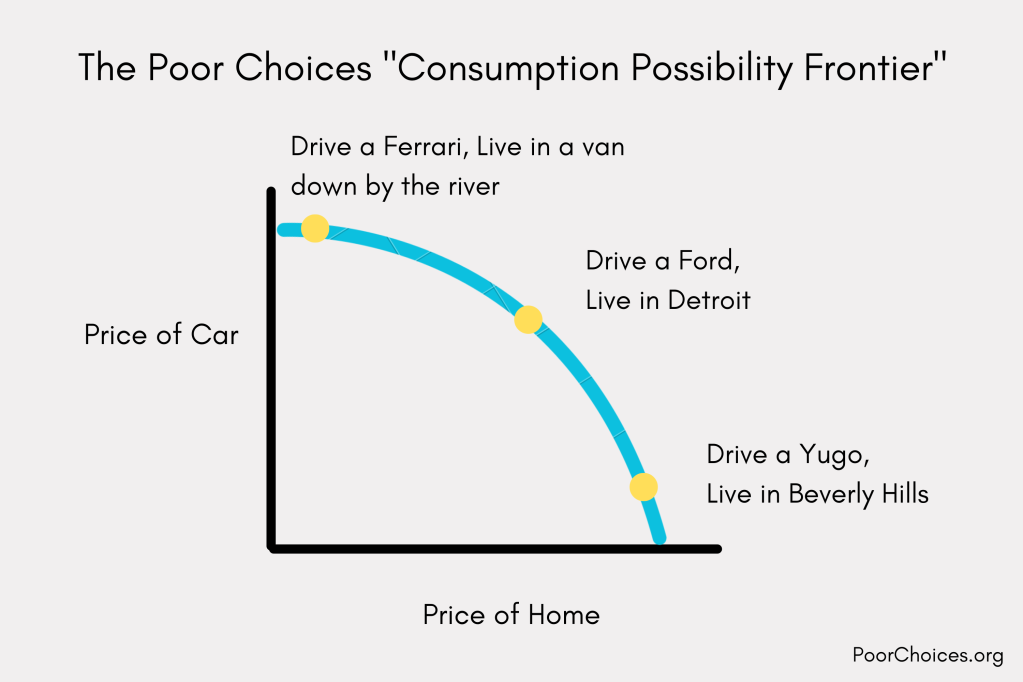

I have a related theory in my own life that I like to call the “consumption possibility frontier”.

It’s the maximum amount of two things that I can buy given my available money and long-term goals. The curve shows the general tradeoff I feel I must make when considering two options for which to spend my money on.

For example, if I want to have a nice home, I need to settle for a less expensive car. I need both of these things, but I only have limited cash, so I can’t have the best of both worlds. If I were to live in a low cost of living area and a smaller house, I could have a nicer car.

Instead, I sit happily in the middle:

This allows me to continue saving for retirement at the same rate and meet other financial goals.

The same goes for travel and other hobbies at home. If I want to travel abroad, I need to be willing to cut back on expensive hobbies like golf or video games at home.

Personal finance, much like global economics, is all about tradeoffs.

More reading:

The Hungry Games: 10 Ways to Beat High Food Prices in 2024

Ten ways to save money on food (with the data to back them up!).

(6 min read)

The Jevons Paradox and Free-Range Eggs

On energy, anthropology, technology, economics, history, and ethical omelets.

(6 min read)

10 Wall Street Sayings for Today’s Market (The 2024 Poor Choices Almanac)

As long as the market has been around, people have been trying to figure it out.

I’ve compiled 10 of my favorite sayings which try to boil down the movements of the market into short and actionable insights.

Here’s the Poor Choices Almanac for how to put those time-tested quotes to good use in…

You must be logged in to post a comment.