Buckle up, this is a long one. But I hope it gives you a good sense for how I think about investing (to be fair, it’s probably the same way a caveman thinks about fire).

“Warm good.”

My legal team would like me to remind you that I don’t give investing advice on this blog. Even if I did, it would be bad advice.

The name of the blog is Poor Choices after all. What do you expect?

I do, however, like to think through various investing scenarios for myself and share those thoughts here. These thoughts are free and worth about the same.

For example, in 2020, I shared a play-by-play of how I was investing during each month at the height of the pandemic and the results were pretty great one year later.

In 2021, I shared the best way to buy the dip. (Spoiler alert, the best way to “buy the dip” is to just keep buying all the time).

And in 2022, I provided a guide to the markets for anyone looking to take advantage of the turmoil of rapidly rising inflation, a sharp climb in interest rates, a war in Europe, and the popping of the market and housing bubble that had dominated much of the prior 2 years.

Please know, I don’t take these types of analyses too seriously.

Macroeconomic conditions are impossible to predict, even if you have the data ahead of time. I’m not putting my life savings into this theory.

95% of my wealth is in tax-sheltered retirement accounts exclusively invested in low-fee index funds. I have emergency cash savings and I don’t have debt besides my mortgage.

At best, this is a fun diversion and should be seen as akin to playing blackjack at a casino. I don’t expect to walk out of the casino with the money I walked in with, but if I do, it’s a pleasant surprise.

Consult an investment professional for any investment-related decisions. These are just words about money.

The Least Credible Analysis You’ve Ever Read

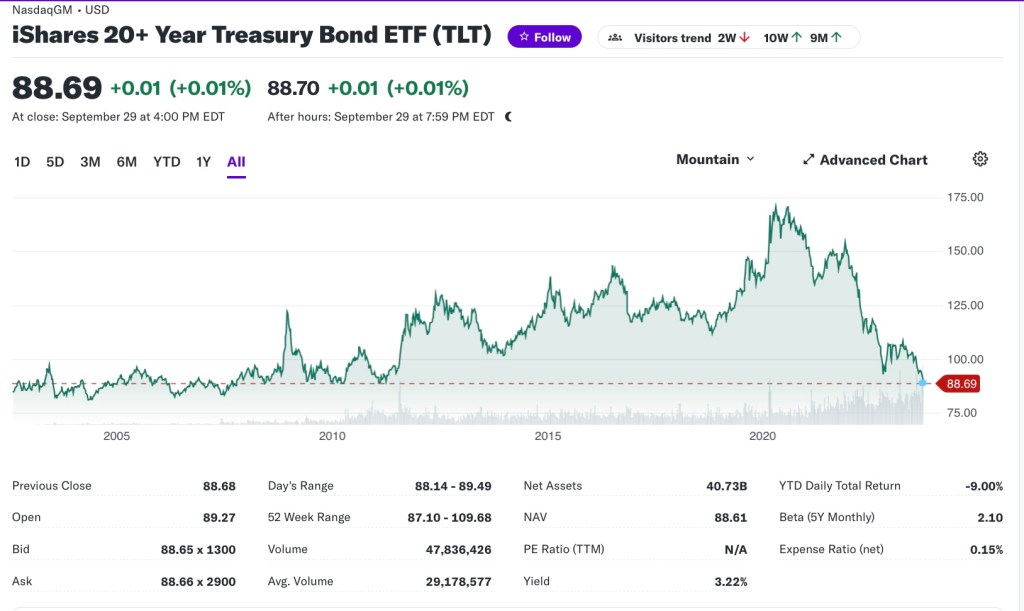

Today I’m going to discuss my investment thesis for TLT, the 20/30 year treasury bond ETF from iShares. I’m not affiliated with iShares (or its owner BlackRock) in any way and there are alternative ETFs that track the same bonds.

Owning bonds can be done through TreasuryDirect.gov or through your brokerage in an ETF.

I’m not opposed to either option. I own Series I Bonds through TreasuryDirect.gov. I also own ETFs through my taxable brokerage account.

If you aren’t familiar, ETFs are like mutual funds, but trade intra-day and typically only track an index whereas a mutual fund can only trade at the close of a trading day and usually has active management rather than tracking an index.

TLT has a 0.15% expense ratio and you’re not buying bonds when you purchase shares of it because you won’t get any of the principal when the bond matures.

You’re buying the yield and the share price.

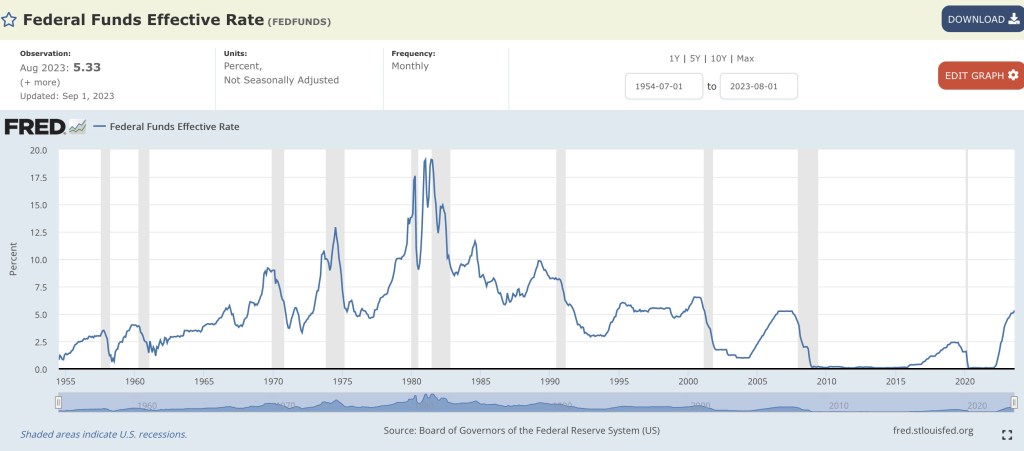

The Fed indirectly sets the yield on bond prices through monetary policy (essentially setting the cost to borrow money from the central bank).

Currently the yield on TLT is 3.22% (which is lower than the yield of buying a bond directly, which is currently 4.37%).

You can check the current price of Treasury bills, notes, and bonds at TreasuryDirect.

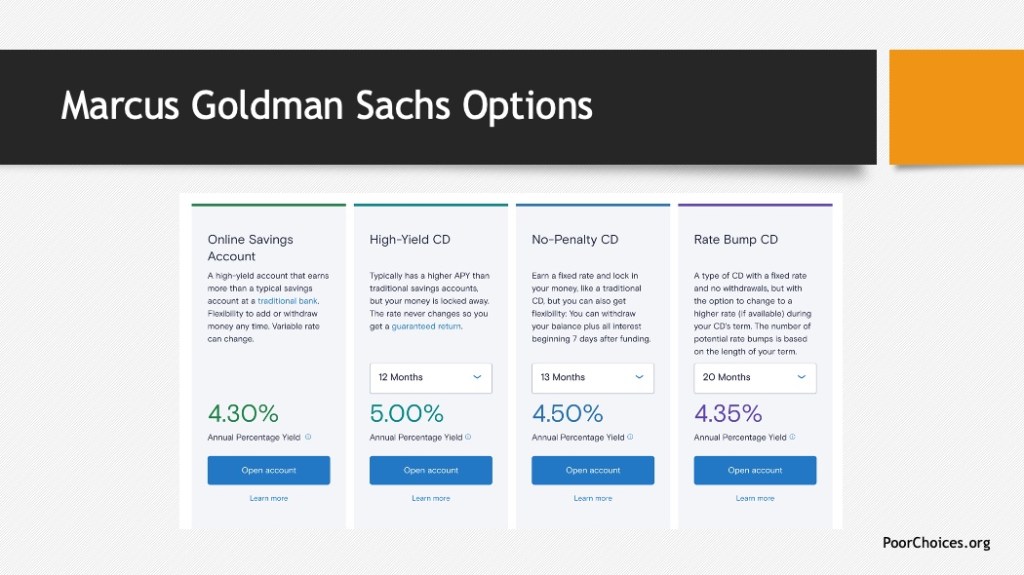

You might be thinking, “Okay, what’s so great about a 3 or 4% yield? I can get more than that in my online savings account with no risk required.”

That’s true.

Here are the current options for yield in my Marcus Goldman Sachs account:

You could even use my referral code to get an extra 1% on a new savings account.

But there is risk to buying TLT (which I’ll discuss momentarily).

And sometimes with risk comes the greater chance of reward.

Buying the bond directly is easy too, but it’s kind of a pain in the butt to sell a bond before maturity. The ETF is more liquid, hence, the 0.15% fee for the convenience.

Here’s the actual thesis now that I’ve laid out what TLT is.

Because TLT tracks the 20-year bond market, when interest rates rise, the price of the ETF falls. It falls because it’s still holding many older bonds paying lower rates. That’s why the chart looks like it does recently (not great).

Since 2010, the Fed had been lowering interest rates. They lowered interest rates to almost 0% during the pandemic. That’s why the ETF did so well during that time, because it continued to own bonds paying more than 0%.

Every subsequent drop in interest rates made TLT look that much better.

But then the pandemic-fueled equity bubble occurred in 2020 and people started seeing inflation and better options for their money so they sold their positions in TLT as the market popped and the Fed smashed the accelerator on interest rates.

With rates now at 5.25-5.5% from the Fed, none of those old bonds paying 0-4% are as attractive.

And if the Fed raises rates again, the ETF will fall even further. But if the Fed stops raising rates, and the market begins to sense a reversal in Fed policy, the ETF should rise in price since it will own so many bonds at such a high rate.

To be fair, no one thought the Fed would be raising as aggressively as they have been. If you’ve owned TLT the past few years, you’ve lost a lot of money (at least on paper).

Many experts believe there may still be another increase but they could start lowering by the middle of next year.

Which brings me to my bull and bear case for TLT as an investment vehicle.

The Bull Case for TLT:

For TLT to perform well, interest rates need to fall.

Here’s a few reasons they could fall:

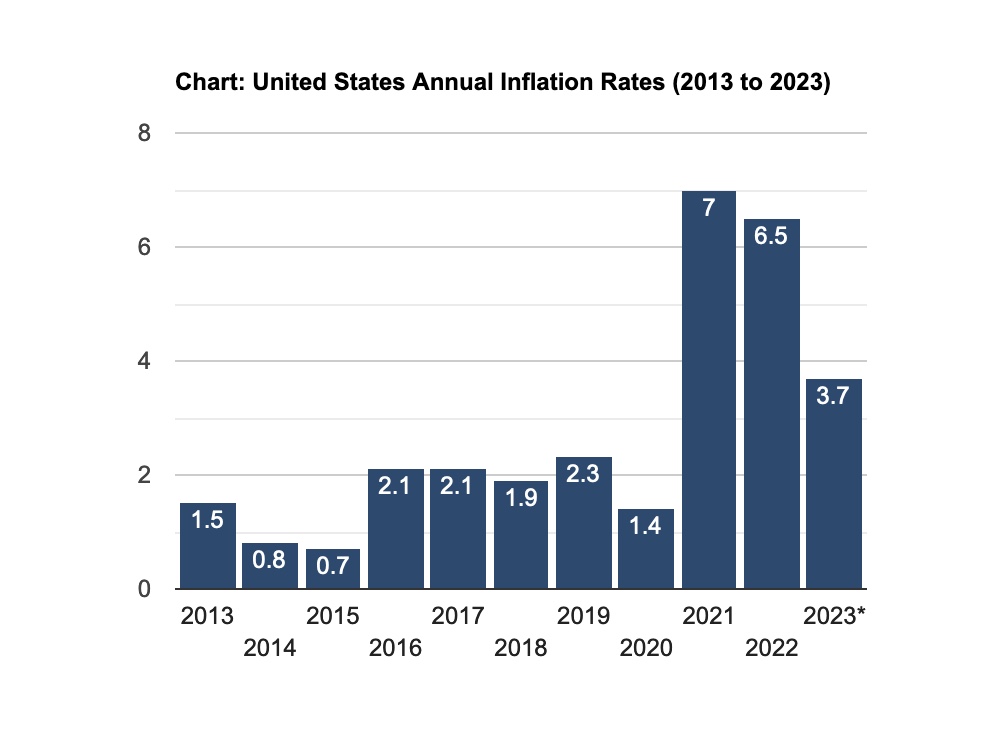

1. “Inflation go down“

Inflation needs to fall to the Fed’s preferred level of about 2% per year. (They say they want 2% a year, but I bet they’d settle for 3%.)

Because inflation was mostly driven by a shortage of goods and the reopening of services, both of which can’t last forever, this seems plausible. They’ve already frozen the housing market and raised credit card and auto loan rates quite high.

Most of the work seems complete. Just on Friday, Sept. 29th, we received another good sign inflation is cooling.

And with student loan repayments beginning again, U.S. consumers may be less inclined to take that extra vacation or buy that new car, all of which will keep inflation on the decline.

“Office occupancy is at its highest level since the pandemic, recently reaching 50.4% of the weekly pre-Covid average occupancy,” according to Kastle Systems, which can be seen as a proxy for how much workers believe they have the upper-hand in work benefits and compensation. This may further slow down the wage-price spiral that led to high inflation.

2. “Unemployment go up“

If unemployment goes up, inflation will slow down, too. People tend to spend less money when they don’t have a job. Weird.

The Fed has literally said people losing their jobs is a necessary evil of keeping a lid on inflation.

Although it’s not skyrocketing, it is ticking up according to the Bureau of Labor Statistics:

3. Election Year

This one is a bit of a conspiracy theory, but incumbent administrations like the stock market to do well during re-election years. The Fed may feel pressured to pause or lower next year to juice the stock market just in time for November 2024.

4. “GDP go down“

Gross Domestic Product (GDP) is all about productivity and countries like growing GDPs. The minute it drops, the Fed can use interest rate reductions to encourage businesses to invest more and create more goods and services.

5. The natural ceiling of interest rates

There is simply a natural ceiling of how high rates can go before the economy breaks. Seven percent mortgages have frozen the entire housing market.

Interest rates need to account for the rate of wage increases and labor constraints.

Unlike in the 1970’s when GDP was growing at 8% and the economy could handle higher interest rates into the teens, we live in a world that simply wouldn’t bear them now.

Mortgage prices as a percentage of disposable income are nearing record highs. Far higher than they were in the 1970s because wages have not kept pace with increases in housing as well as healthcare and education. Big ticket items.

The Bear Case for investing in TLT

For TLT to perform poorly, interest rates need to keep rising. When rates go up, bond prices fall and so will the price of TLT.

1. All of the above bull cases in reverse.

If inflation begins to rise again, or unemployment stays low, or productivity rises, the Fed will keep raising rates in an attempt to cool it all down.

2. The U.S. Dollar is no longer the world’s reserve currency

I watched a fascinating video from Ray Dalio discussing what happens to a country when they are no longer the world’s reserve currency. It’s a reinforcing cycle of fast economic, military, social and political decline.

It would also mean the U.S. would need to default on its debt (the bonds it issues among other things).

This would not be good for bond prices.

But if this is happening, I will have bigger concerns than a small portion of my portfolio.

3. I buy TLT too early.

Another risk is timing. I think this is the biggest risk.

It’s not a matter of if the Fed will lower interest rates ever again. It’s a matter of when.

There’s no award for complexity in investing. One response to this risk is to just simply wait until it’s clear the Fed is staying put for awhile at a specific interest rate level.

I could also wait for all of the economic signals outlined in the bull case to deteriorate meaningfully.

Both strategies would eliminate some of the risk but also some of the reward.

4. I sell TLT too early.

Even if I buy it on time, I could sell my position too early. Sometimes the Fed raises and lowers rates very quickly (just look at the 1980s).

The risk would be leaving some principal appreciation on the table. Not the worst.

In Conclusion

Dollar-cost-averaging into and out of the ETF will be the way I intend to hedge these risks. Continuously adding to my position with each month that passes until the lowering cycle begins and then slowly selling my oldest positions (to avoid short term cap gains taxes) as time goes on.

I’m sure I’m missing something here. I could be completely wrong. It’s a short term trade and those rarely go the way you think. But if I’m wrong, at least I’m not the only one:

The above chart shows YTD flows for various ETFs. As you can see, TLT has taken in A LOT of money over the past year. The fund now has over 40 billion dollars in it.

But that’s not a great sign either.

I hear the haunting ring of my mother yelling at 10-year-old me after getting into trouble for something with my friends:

Me: “But all my friends were doing it!“

My mother: “If your friends jumped off a bridge, would you do it, too?!”

More Reading:

What Is a Buyer-Agent Agreement – And Why It’s the Smartest Move You Can Make When Buying a Home

Buying a home is too big of a decision to go it alone or leave it to chance. That’s where a Buyer-Agent Agreement comes in.

Keeping Up with Yourself

Keeping up with yourself can be a great fuel—and an even greater trap. The art is knowing when to press forward, and when to simply be where you are.

(5 min read)

Why You (and I) Need a Career Coach

I messed up at work but survived — thanks to my career coach. Spoiler alert: British football analogies included.

You must be logged in to post a comment.